Like any insurance company, cyber insurance providers charge based on your risk profile. The higher your potential risks, the more your cyber liability insurance costs. Luckily, there are steps that you can take to make sure your cyber insurance costs less.

| “Lessening your cyber risks can save you time and money in a lot of different ways. You will be at less risk of liability and your cyber insurance will cost you less.” – Jason Sondhi, CEO, EXOS IT |

Cyber insurance providers evaluate several key factors when determining premiums. These factors include your organization’s size, industry, data sensitivity and overall cybersecurity posture. Organizations in high-risk sectors or those lacking mature defenses tend to face higher premiums.

Working with the right cybersecurity partner can help you establish more mature cybersecurity processes. Having this assistance may help organizations of all sizes enjoy lower premiums compared to what the price would be without it. The rest of this article will explain why having cyber insurance is important, its average cost and why cybersecurity services lower costs.

Why It’s Important to Have Cyber Insurance Coverage

Cyber insurance helps reduce the financial impact of cyber attacks by covering response and data recovery costs. Cyber insurance can also help you meet compliance obligations by covering the cost of audits, reporting and third-party claims arising from security incidents.

Without this coverage, organizations may struggle to recover from the full financial and operational impact of a breach.

How Much Does Cyber Insurance Cost on Average?

The average cost of cyber insurance in the US is $132 per month, which comes to $1,589 annually. However, this number will fluctuate based on the insurance provider you choose and your risk profile.

Premiums reflect the rising costs of incident response, legal costs and regulatory fines. Cyber threats are increasingly sophisticated, which means that they are more expensive to mitigate. Insurance providers match their prices to follow suit.

Defend Your IT Systems Using 7 Layers of Protection |

How The Right Cybersecurity Partner Can Lower Your Cyber Insurance Premiums

Reduced Attack Surface

A cybersecurity partner minimizes possible exposure by identifying vulnerabilities, hardening systems and restricting unnecessary access. This reduces the probability of a breach, which lowers the perceived risk used to calculate insurance premiums.

Active Threat Monitoring

Most cybersecurity providers deploy 24/7 monitoring tools to detect unauthorized activity and flag suspicious behavior so that they can mitigate potential damage. Having 24/7 coverage can make a big difference to your attack surface.

For instance, 81% of ransomware attacks are enacted outside regular business hours. Because this lowers both risk exposure and claims severity, insurers adjust coverage pricing accordingly.

| Learn More About How You Can Protect Your Data |

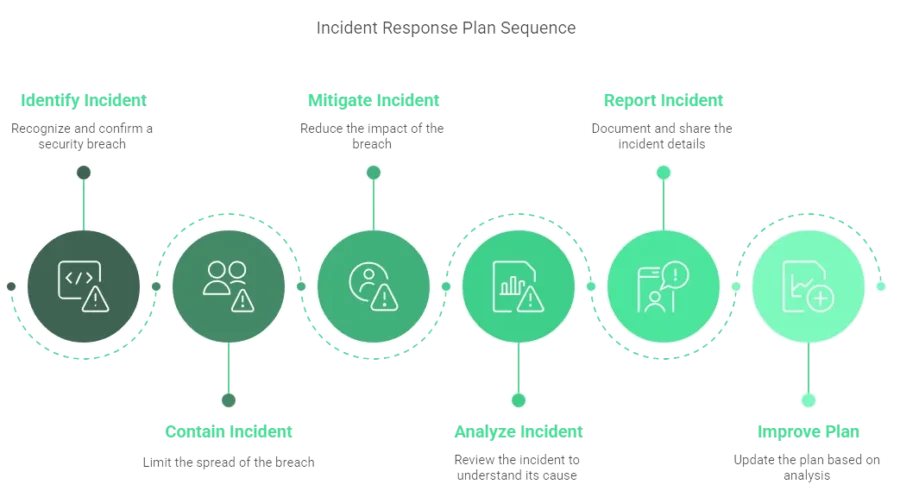

Incident Response Planning

A cybersecurity partner will help you build a tailored incident response plan that outlines clear roles, procedures and communication protocols. A good provider will also test and update the plan regularly to maintain readiness. Insurance providers often lower premiums when an organization can show exactly how they will contain threats and reduce damage during a cyber incident.

Security Awareness Training

Structured training programs that focus on real-world attack scenarios, such as phishing, credential harvesting and social engineering improve employee judgment and reinforce secure behavior. Insurers recognize that reducing human error directly lowers the probability of a successful breach.

Regular Risk Assessments

A cybersecurity partner conducts scheduled assessments to uncover configuration flaws, privilege overreach and other internal security gaps. They then present prioritized findings and guide mitigation actions based on threat impact. Insurers favor this proactive approach because it reduces the chance of high-cost claims stemming from overlooked weaknesses.

Here is an overview of some of the key aspects of a comprehensive risk assessment.

| Key Consideration | |

| Threat Impact Alignment | Assess risk levels based on potential operational disruption and data exposure. |

| Privilege Review Scope | Identify elevated access across systems and validate against role-based requirements. |

| Misconfiguration Detection | Detect deviations from hardened baselines across cloud, network and endpoint assets. |

| Remediation Guidance | Deliver actionable steps aligned with threat intelligence and system dependencies. |

| Historical Risk Trends | Track recurring issues to refine controls and demonstrate measurable risk reduction. |

Network Segmentation

You can ask your cybersecurity partner to segment critical systems from general-use networks to limit attacker movement inside your environment. They will also enforce policies that isolate sensitive data, control internal access and contain breaches within low-value zones.

Insurers view segmentation as a core control that minimizes potential damage, especially since IBM’s 2024 Cost of a data breach report found that lateral movement within IT networks contributed to 25% of data breaches.

Detailed Security Logs

A cybersecurity partner centralizes and secures logs across all systems. These logs may track authentication events, access patterns and administrative actions. Monitoring your logs in real time and retaining them supports investigations and claims validation. It’s also a useful tool for compliance audits when needed. Insurers value this level of visibility and accountability because it simplifies reviews.

| EXOS IT is More Than Just a Cybersecurity Partner

Explore Our Other IT Services |

Choose EXOS IT as Your Cybersecurity Provider

Lowering your cyber insurance premiums starts with reducing your overall cybersecurity risk. While every policy is different, insurance providers reward organizations that demonstrate strong cyber hygiene. These improvements don’t just affect your insurance premiums—they also protect your long-term operational stability.

At EXOS IT, we help organizations strengthen their defense posture with precision and expertise. Our focus is a defense-in-depth approach that combines threat detection, incident readiness, network segmentation and real-time log visibility into one coordinated service. We support compliance, reduce risk and help you meet the cybersecurity standards insurance providers are looking for.

Speak with us today to learn how we can help your organization lower cyber insurance costs.